Cash margin meaning

A diversified portfolio translates to reduced. But unlike net income the CFO provides a more accurate picture of how much money a company is making.

Net Income Formula Calculation And Example Net Income Accounting Education Income

In margin trading liquidation margin is the current value of a margin account including cash deposits and the market value of its open positions.

. The cash receipt journal line items are used to update the subsidiary ledgers such as the accounts receivable ledger. An investor with a margin account would be able to purchase 5000 of Company XYZ or 1000 shares. Zomedica ended the quarter with cash and cash equivalents of 1868 million reflecting use of 55 million of cash during the quarter including its purchase of a 1 million convertible note from.

Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees. Day trade until the customer deposits cash or securities into the account to restore the account to the 25000 minimum equity level. The net profit margin is typically expressed as a percentage but can also take decimal form.

No it is all treated as call option writing. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Operating Cash Flow Margin.

No margin benefit you get because you are writing calls on the same stock. Cash Reserve Ratio Meaning. Net cash used in operating activities for the six months ended June 30 2022 was 65 million compared to 44 million for the six months ended June 30 2021 an increase in cash used of 21 million or 49.

So we usually tell clients to keep anything between 10 to 20 of the margin required in cash. Even if the Cash cycle is very useful to find out how fast or slow a firm can convert inventory into cash there are few limitations that we need to pay heed to. ADJUST THE CASH ACCOUNT.

The increase in cash used in operations primarily resulted from the increase in our operating loss. Cash accounts and margin accounts. Margin Rules for Day Trading.

For example cash from operations CFO is a commonly used metric. If your business has a larger margin than another it is likely a professional buyer will see more growth potential in yours. Margin requirements for equities are normally 2-to-1 for the average investor meaning youll purchase double your cash balance.

More Buying Power Definition. It is an alternative to net income. Information is recorded in the cash receipts journal from the appropriate source documents such as bank paying-in books bank statements and advice slips.

Compare the cash accounts general ledger to the bank statement to spot the errors. EBITDA margin EBITDA Total Revenue. Noun the part of a page or sheet outside the main body of printed or written matter.

Settled cash is a phrase used by traders and brokerage firms to refer to the amount of cash an investor has available to buy and sell securities in a cash account. The operating cash flow can be found on the. The net profit margin is a consideration or net profit net income as a percentage of the companys revenue.

ArcelorMittal however has a cash conversion cycle of 2441 days below the industry average. The use of the cash receipts journal is a three step process. Cash Reserve Ratio CRR is the amount of cash banks need to hold on to without being allowed to invest or lend it for interest.

Also known as the reserve ratio this percentage lets the commercial banks find out the portion of monetary reserves they need to keep with their respective central banks. Both allow you to buy and sell investments but margin accounts also lend you money for investing and come with. Profit margin is calculated with selling price or revenue taken as base times 100.

In other words net profit margin is the ratio of net income to revenues for a given company. The next step is to adjust the cash balance in the business account. A margin loan gives you more buying power meaning you can buy more different securities like stocks bonds mutual funds and exchange-traded funds.

Net profit margin calculation. The reason why the cash must be settled is that the trader must wait a sufficient amount of time to receive the cash proceeds resulting from a sale transaction or a trade position. By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year.

It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. That same 10 price move would mean youd then make 10000 and earn a 300 return. ALL MTM losses has to be paid in cash to the exchange.

Tenaris has a cash cycle of 20405 days way above the industry average. Online brokers offer two types of accounts. If you have questions concerning the meaning or application of a particular law or rule please consult with an attorney who specializes in securities law.

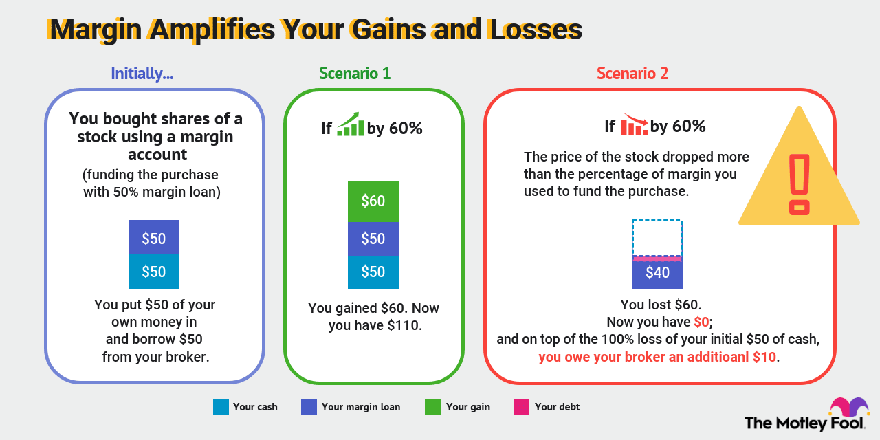

Gains Losses Work Both Ways. Cash flow ratios are financial ratios calculated by comparing the metrics in the cash flow statement with other items in the financial statements.

How To Calculate Contribution Margin In 2022 Contribution Margin Accounting Education Accounting And Finance

Financial Management Formulas Part 1 Business Strategy Management Financial Management Financial Accounting

Operating Margin Ratio

Drawing Power In 2022 Accounting Books Financial Institutions Credit Monitoring

/margin-Final-3f618f933cef49bfb09a93f91344e1ae.png)

7ia0hydcgqfeym

Common Financial Accounting Ratios Formulas Cheat Sheet By Davidpol Download Free From Cheatography Che Financial Accounting Accounting Cost Accounting

What Is Margin In Trading Meaning And Example

Ebit Meaning Importance And Calculation Bookkeeping Business Accounting Education Small Business Bookkeeping

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

What Are Accounting Ratios Definition And Examples Market Business News Accounting Education Bookkeeping Business Accounting

Fixed Cost What It Is And What S Its Importance Accounting Education Accounting And Finance Bookkeeping Business

/margin-Final-3f618f933cef49bfb09a93f91344e1ae.png)

7ia0hydcgqfeym

What Is Margin Trading Things To Know Ally

Financial Ratios Financing Constraints Sample Dissertations Financial Ratio Financial Statement Analysis Accounting

What Is Margin And Should You Invest On It

Accounting Ratios Financial Ratios Are Calculated Within A Firms Financial Statement To See How Profitable It I Financial Ratio Accounting Financial Analysis

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial